The Hidden $42 Billion Problem That's Eating Your Favourite Startups Alive: Part 1

Why chargebacks are the silent revenue killer every B2C founder needs to understand?

What The Hell Is A Chargeback, Anyway?

Picture this: You order a sick pair of limited-edition sneakers online for $300. They arrive, you post them on Instagram, life is good. Three weeks later, you check your credit card statement and think, "Hmm, $300 for shoes? That seems irresponsible. I definitely didn't authorise this purchase."

So you call your bank and dispute the charge. Boom – you just initiated a chargeback.

The technical definition: A chargeback is a payment dispute mechanism that allows cardholders to reverse a transaction through their issuing bank, effectively forcing the merchant to refund the purchase while keeping the product.

Originally created in 1974 as part of the Fair Credit Billing Act, chargebacks were designed as a consumer protection mechanism. The idea was noble: protect people from fraud and unfair merchant practices. Fast forward 50 years, and it's become the financial equivalent of having a personal army that fights your battles, wins every time, and sends the bill to whoever made you angry.

Here's what makes chargebacks particularly brutal for merchants:

They lose the product (customer keeps it or it is lost in shipment)

They lose the revenue (money gets reversed)

They pay chargeback fees (typically $15-100 per dispute)

They waste operational resources fighting disputes

They risk getting blacklisted by payment processors if ratios get too high

It's like getting robbed, then having to pay the robber's legal fees.

The Market Size: It's Bigger Than You Think

Global Chargeback Market Size:

Expected to increase from $33.79B in losses to $41.69B by 2028 (23% increase)

Transaction volume: Growing from 261 million disputes (2025) to 324 million (2028) - a 24% increase

25% of merchants report annual chargeback volume higher than 1 million transactions

13% of merchants have chargeback volume averaging 2% or higher of their total transaction volume

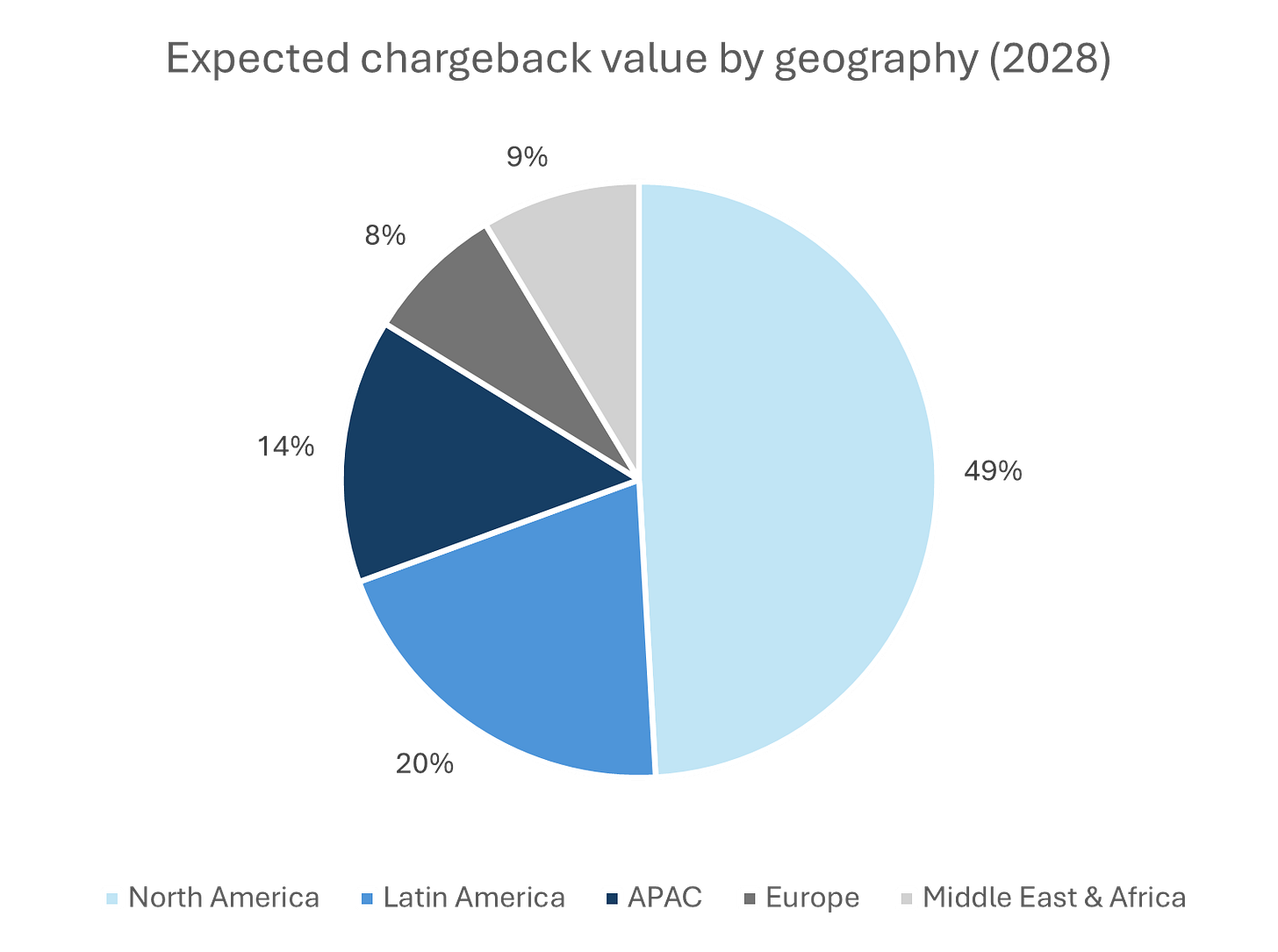

Regional Chargeback Growth Forecast (2025-2028)

The growth isn't evenly distributed globally. Some regions are getting hit much harder:

Middle East & Africa: 59% growth (highest globally - digital transformation creating new fraud vectors)

Asia Pacific: 35% growth (eCommerce expansion attracting more disputes)

Europe: 27% growth (stricter regulations, but still significant growth)

Latin America: 22% growth (online retail growth with limited fraud prevention)

North America: 16% growth (lowest percentage, but highest absolute volume)

The Middle East and Africa seeing 59% growth is particularly noteworthy - that's regions where digital payment infrastructure is rapidly expanding but chargeback management expertise hasn't caught up yet.

Industry Breakdown by Average Chargeback Value:

Travel & Hospitality: $120 (highest - thanks, cancellation policies)

High-risk categories (gaming, crypto): $99

Retail: $84

Digital goods: $77

Subscription services: $69

But here's the kicker - it's not just about value, it's about fraud rates:

High-risk categories (gaming, gambling, crypto): 52% of chargebacks are fraudulent

Travel and hospitality: 46% fraudulent chargebacks

Retail, Digital goods, Subscription services: 43% fraudulent chargebacks

The subscription economy deserves special mention here. With the market expected to hit $904.2B by 2025, and subscription services having notoriously high chargeback rates due to "billing descriptor confusion" (aka people forgetting they signed up for that meditation app), this is becoming a massive problem.

Why This Is A Critical Problem (Beyond The Obvious Money Loss)

1. The Fraud Paradox

Here's the kicker: 75% of chargebacks aren't actually fraud (i.e. they aren’t criminal, for example, transactions from a stolen card). They're "friendly fraud" – legitimate customers disputing legitimate purchases. This includes:

Buyer's remorse (65.3% of friendly fraud cases)

Not recognising the billing descriptor

Wanting to avoid return policies

Straight-up gaming the system because it's easier than getting a refund

Fun fact: 84% of customers say filing chargebacks feels easier than requesting refunds. Because apparently clicking "dispute" is less effort than clicking "contact support."

Here's what actually happens when merchants decide to fight back.

54% of chargebacks get represented (merchants actually fight them)

Merchants win 50% of representment cases on average

Only 4.8% of cases advance to arbitration/pre-arbitration

Size matters: 52% of large enterprises win more than half their cases vs only 36% of mid-market companies

The takeaway? Fighting chargebacks isn't futile, but you need resources and expertise to do it effectively.

2. The Amplification Effect

Every $1 lost to fraud actually costs merchants $4.61 when you factor in:

Chargeback fees

Operational costs (staff time, legal fees)

Lost inventory

Payment processing penalties

Increased insurance costs

It's like financial compound interest, but in the wrong direction.

Also, it's not just merchants paying the price. Banks are haemorrhaging money too:

Each dispute costs financial institutions $9.08 to $10.32 to process

Banks require one full-time employee for every $13-$14k in annual cardholder disputes

U.S. financial institutions employ over 200 back-office staff for chargeback management, costing millions annually

Moving to digital-first dispute processes increases dispute volume by 30% to 40%

The irony? Banks make dispute filing easier to reduce call center costs, then get hit with more disputes to process.

3. The Death Spiral Risk

Payment processors monitor chargeback ratios religiously. Cross certain thresholds (historically around 1%, now getting stricter), and you enter what I call the "payment processor death spiral":

Higher processing fees

Rolling reserves (they hold your money hostage)

Eventual account termination

Difficulty finding new processors

Business closure

Many promising startups have struggled not from lack of demand, but from payment processor issues triggered by chargeback problems.

The Key Players: Who's Who In The Chargeback Ecosystem

Understanding the incentives of each player explains why the system is so broken:

1. Cardholders (The Customers)

Incentive: Get money back quickly with minimal effort

Risk: Virtually none (banks rarely prosecute friendly fraud)

Power level: Maximum

2. Issuing Banks

Incentive: Keep customers happy, avoid regulatory issues

Risk: Minimal (they can claw money back from merchants)

Default position: Side with cardholders

Fun fact: 72% of issuers classify disputes as fraudulent vs only 45% of merchants. This massive disconnect explains why the system feels rigged against merchants. Issuers default to assuming fraud while merchants see legitimate customer behaviour patterns.

3. Card Networks (Visa/Mastercard)

Incentive: Process volume, collect interchange fees

Role: Make rules, collect arbitration fees

Recent trend: Getting stricter with merchants (we'll cover this extensively in Part 2)

4. Acquiring Banks/Processors

Incentive: Minimise risk, maintain card network relationships

Risk: High (liable for merchant defaults)

Response: Strict merchant monitoring, quick account terminations

5. Merchants

Incentive: Keep selling, minimise disputes

Risk: Maximum (lose money, product, and processing ability)

Power level: Minimal

Success mantra: "The customer is always right, even when they're committing fraud"

Now that we understand the players, let's dive into the biggest driver of this mess: friendly fraud.

The Friendly Fraud Epidemic

Let's talk about the elephant in the room: Friendly Fraud or First Party Fraud. This isn't your traditional "hacker steals credit card" fraud (Third Party Fraud). This is your legitimate customers actively screwing you over, and it's becoming an epidemic.

The Numbers Don't Lie

75% of chargebacks are friendly fraud (per Visa estimates)

40% of consumers who commit friendly fraud will do it again within 60 days

1 in 4 customers openly admits to engaging in friendly fraud

42% of Gen Z shoppers have admitted to first-party fraud

Why It's Exploding

1. Digital-First Dispute Process: Banks have made disputing transactions stupidly easy. Most major banks now let you dispute charges through their mobile app with literally two taps. Compare that to calling the merchant's customer service and waiting on hold for 20 minutes.

2. Consumer Education (The Wrong Kind): Social media has tutorials on "how to get free stuff" through chargebacks. TikTok and YouTube are full of content promoting chargeback abuse as "life hacks".

3. Billing Descriptor Confusion: Customers see "PAYPAL *ACME CORP" on their statement and have no idea what it is. Instead of checking their email or thinking for 30 seconds, they dispute it as fraud.

4. The Subscription Problem: Free trials that convert to paid subscriptions are chargeback magnets. Customers sign up, forget about it, see the charge, and immediately dispute rather than cancel properly.

5. Buyer's Remorse Weaponisation: Traditional return policies have timelines and conditions. Chargebacks don't. Bought something expensive and feeling guilty? Just dispute it as "unauthorised."

The Psychology

Here's what's really happening: Cognitive dissonance. Customers make impulsive purchases, then rationalise disputes as "sticking it to big corporations" or "getting my money back from sketchy merchants." They don't see themselves as committing fraud – they see themselves as smart consumers gaming a rigged system.

The problem is that they're usually gaming small businesses and startups that can least afford it.

What's Coming in Part 2

The friendly fraud epidemic is just the tip of the iceberg. In Part 2 of this series, we'll dive deep into:

The Technical Chargeback Process: A step-by-step breakdown of how disputes actually work, including the role of Rapid Dispute Resolution (RDR) and pre-arbitration

The VAMP Rules Revolution: How Visa's new monitoring program is making compliance harder for merchants

Market map: Founders building recovery and prevention tools in this space

You can now read Part 2 here.

If you are building in this space or any other Fintech infrastructure and want to have a chat, please reach out to me at mridul@un-bound.com

Sources:

Chargeflow State of Chargebacks Report 2025

Visa Global Fraud Report 2024

Chargebacks911 Industry Analysis 2025

Datos Insights Chargeback Forecast 2025

Consumer Attitudes Towards Chargebacks Survey 2024

Subscription Economy Report 2024

Visa Dispute Analytics Report 2024

Friendly Fraud Psychology Study 2024

Consumer Banking Preferences Survey 2024

True Cost of Fraud Study 2025 23-24. Issuer vs Merchant Perspective Analysis 2024

Visa Chargeback Classification Report 2024 26-27. Repeat Fraud Behaviour Analysis 2023

Consumer Fraud Admission Survey 2024

Gen Z Payment Behaviour Study 2024

Friendly Fraud Growth Projections 2024-2026