The Future of the CFO Suite: Navigating Disruption and Innovation

The CFO suite has long been dominated by legacy platforms like Xero, QuickBooks, and NetSuite. These tools have become deeply embedded in financial workflows, forming the backbone of accounting and financial data management across industries. While their dominance remains unshaken, the emergence of AI-driven tools and new players raises an intriguing question: Is the era of Xero and QuickBooks over, or will their moat and massive adoption allow them to defend their turf? This blog explores the current landscape, emerging trends, and the pathways for meaningful disruption in the accounting space.

Dominance of Legacy Players

Accounting is inherently horizontal. Regardless of the business model or sector, numbers still need to be reconciled, taxes filed, and financial statements prepared. This universality is a key reason why platforms like Xero, QuickBooks, and NetSuite have achieved widespread adoption across diverse industries and geographies. They provide essential tools that meet the fundamental requirements of businesses, making them indispensable for managing financial operations.

A major factor behind their strong foothold is their data moat. These platforms house years of historical financial data critical for compliance, reporting, and strategic analysis. Transitioning away from them can be daunting for businesses, as it risks losing access to this valuable information. Moreover, the integration of standalone tools—either through Xero’s extensive app store or third-party solutions that inject data into these platforms—has created an ecosystem that supports a wide variety of use cases, from payroll to inventory management. Lastly, these platforms have become the de facto choice, thanks to strong word-of-mouth and years of usage by CFOs and finance teams, which has fostered deep familiarity and trust. All of this has cemented their position as indispensable tools for businesses.

However, as the economy and technology have evolved, the number of businesses within specific verticals has grown significantly. For instance, building an accounting solution designed specifically for D2C online businesses might not have been economically viable 15 years ago, but today it has become a lucrative opportunity. These modern tools can address the unique operational and financial challenges faced by such businesses, going beyond the generalist capabilities of legacy platforms. Furthermore, an entrepreneur starting a D2C business today has no “legacy baggage” and would be open to using a custom-built accounting solution rather than a generalist incumbent solution. More on this later.

Emerging Categories of Solutions

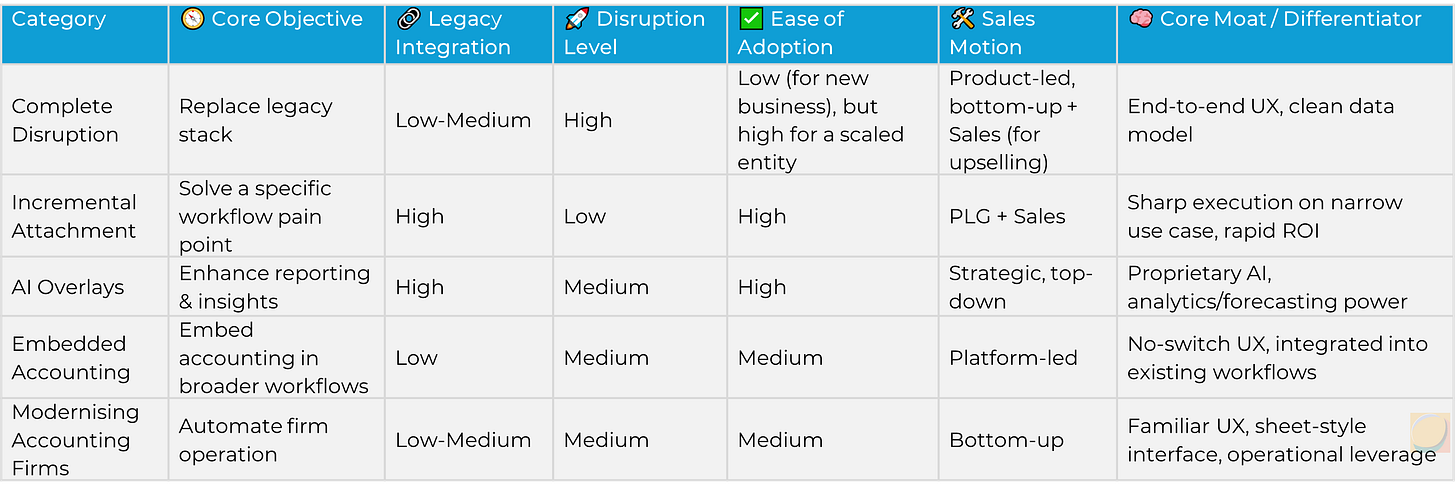

The surge of innovation in the CFO suite can be categorised into five distinct approaches:

Complete Disruption

Startups like Digits aim to replace legacy systems entirely, offering comprehensive solutions built on the latest AI technology that unify ledgers, reporting, and analytics. These platforms seek to simplify workflows by eliminating the need for multiple tools.

Incremental Attachment

Solutions like Brex and Ramp focus on specific pain points, such as expense management or AR/AP. These tools integrate seamlessly with legacy systems, providing immediate operational relief without requiring a full-stack replacement.

AI Overlays

Tools like Concourse leverage AI to enhance existing systems. They provide advanced capabilities such as real-time analytics and automated reporting, sitting on top of legacy platforms rather than replacing them.

Embedded Accounting

Platforms like Layer embed accounting directly into vertical SaaS ecosystems, reducing platform sprawl for SMBs and handling core workflows like reconciliation and closing books. The B2B2B model benefits all parties: Layer gets distribution via white-labeled partnerships, SaaS platforms boost ARPU and retention through cross-sell, and SMBs no longer need to export data to tools like Xero or QuickBooks—they manage everything natively within their primary platform.

Modernising Accounting Firms

Tools like Liveflow focus on improving the efficiency of accounting firms by automating routine tasks, enabling accountants to manage more clients and shift to higher-value advisory roles.

An auxiliary avatar of this model is to build a software for accounting firms and then start a roll-up in a PE-like fashion.

Each of these approaches is carving out a niche by addressing specific gaps in the market, but how can they win against entrenched incumbents?

How Can Disruption Percolate?

Lessons from history are essential for understanding disruption, as they show how even businesses with strong distribution and data moats can be unseated by new players. Consider the case of Shopify and Toast, two standout examples of vertical SaaS successfully challenging entrenched incumbents by addressing specific sector needs.

Shopify disrupted horizontal e-commerce platforms like Magento and WooCommerce by creating an intuitive, fully integrated solution tailored for online retailers. It focused exclusively on the unique challenges of this segment, such as managing storefronts, inventory, and customer experience, to provide a seamless platform. Similarly, Toast replaced legacy restaurant management systems like Micros and Aloha with an end-to-end platform that streamlined critical operations, including inventory management, payment processing, and customer service. Both companies emerged victorious by solving the pain points of their target sectors and offering specialised features that generalist platforms could not.

In accounting, niches like online businesses or multi-entity operations present similar opportunities. These businesses face challenges such as multi-currency transactions, intercompany reconciliations, and tax complexities. Vertical solutions that address these pain points can carve out a loyal user base.

This shift was highlighted by Clayton Christensen in his Theory of Disruptive Innovation. Disruption often starts in overlooked niches, where incumbents have little incentive to compete. Over time, these niche players improve their offerings and move upstream, challenging established players in their core markets. For Xero and QuickBooks, their biggest strength—being generalist platforms—could also be their greatest vulnerability. Tailored solutions built from the ground up can exploit gaps that incumbents cannot address effectively.

Xero and QuickBooks have recognised this threat and have started incorporating AI to enhance reporting and automation. Yet, their incremental improvements may not be enough if a new wave of solutions redefines the rules of the game.

Summary and Conclusion

The future of the CFO suite lies in the balance between automation and strategic advisory. As data input and processing become increasingly automated, the focus will shift to complex decision-making and value-added services. For entrepreneurs building in the space, the key to success lies in identifying a specific niche, defining an ideal customer profile (ICP), and creating a product that delivers undeniable value.

Disruption will favour those who can:

Target underserved markets with customised solutions.

Leverage AI to automate repetitive tasks and enhance accuracy.

Build products that make the transition from traditional software seamless and compelling.

The race to transform the CFO suite is well underway. While legacy platforms remain dominant, their generalist approach creates opportunities for innovative players to carve out niches and redefine the market. The next decade will reveal whether the incumbents adapt or if a new generation of tools will emerge to dominate the space.